Property Taxes Maryland Counties . Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets. Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home value, and percentage of. Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Web maryland property taxes. Counties are responsible for the county tax rates, local. Taxes on real estate in maryland account for a significant portion of both of. The average property tax rate in maryland is 1.02%. View the property tax rates in. Web property taxes vary across maryland based on county. Every august, new tax rates are posted on this website.

from itep.org

The average property tax rate in maryland is 1.02%. Taxes on real estate in maryland account for a significant portion of both of. Web property taxes vary across maryland based on county. View the property tax rates in. Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home value, and percentage of. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Every august, new tax rates are posted on this website. Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. Web maryland property taxes. Counties are responsible for the county tax rates, local.

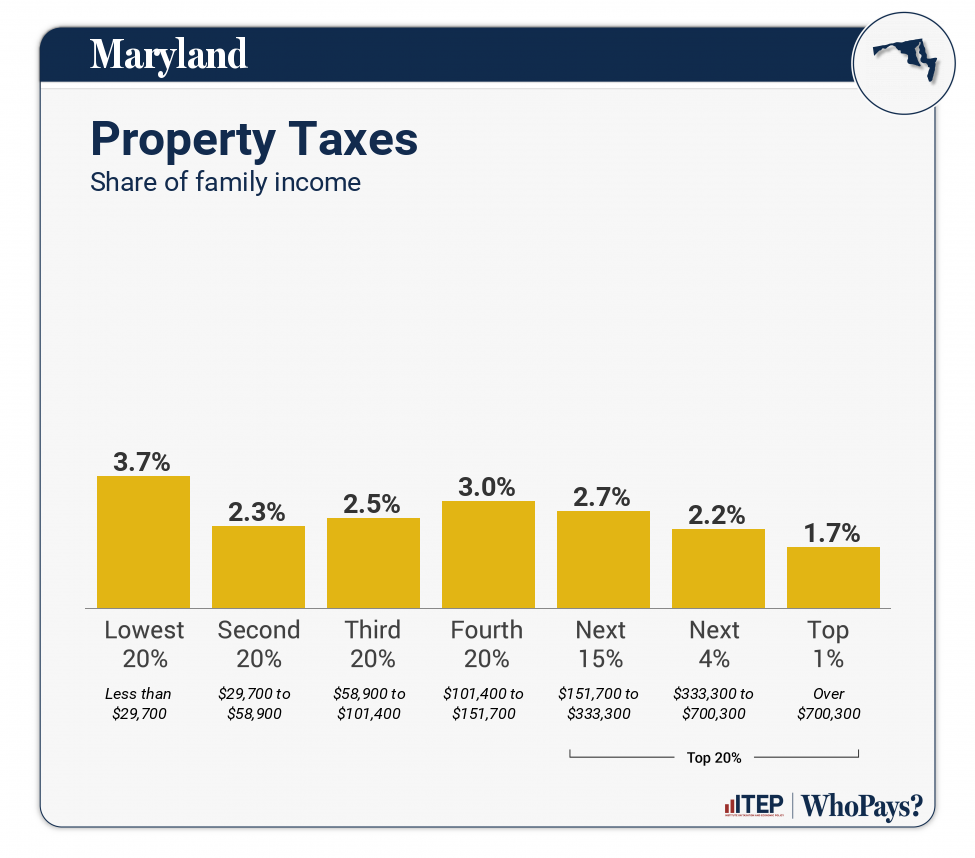

Maryland Who Pays? 7th Edition ITEP

Property Taxes Maryland Counties View the property tax rates in. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home value, and percentage of. Every august, new tax rates are posted on this website. Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. Counties are responsible for the county tax rates, local. View the property tax rates in. Web maryland property taxes. The average property tax rate in maryland is 1.02%. Web property taxes vary across maryland based on county. Taxes on real estate in maryland account for a significant portion of both of. Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Taxes Maryland Counties Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. The average property tax rate in maryland is 1.02%. Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets. View the property tax rates in. Web. Property Taxes Maryland Counties.

From frederickrealestateonline.com

A Comprehensive Guide to Property Taxes in Maryland Frederick Real Property Taxes Maryland Counties View the property tax rates in. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets. Counties are responsible for the county tax rates, local. Web. Property Taxes Maryland Counties.

From hometipsforwomen.com

Property Taxes What You Need to Know Home Tips for Women Property Taxes Maryland Counties Web maryland property taxes. Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets. Every august, new tax rates are posted on this website. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Web maryland's. Property Taxes Maryland Counties.

From itep.org

Maryland Who Pays? 6th Edition ITEP Property Taxes Maryland Counties Web property taxes vary across maryland based on county. Every august, new tax rates are posted on this website. View the property tax rates in. Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. The average property tax rate in maryland is 1.02%. Taxes on real estate in maryland. Property Taxes Maryland Counties.

From www.civicfed.org

2017 Effective Property Tax Rates in the Collar Counties Civic Federation Property Taxes Maryland Counties Web property taxes vary across maryland based on county. Taxes on real estate in maryland account for a significant portion of both of. Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home value, and percentage of. The average property tax rate in maryland is 1.02%. Web maryland property taxes. Web maryland's 23 counties,. Property Taxes Maryland Counties.

From www.steadily.com

Maryland Property Taxes Property Taxes Maryland Counties Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Counties are responsible for the county tax rates, local. View the property tax rates in. Web maryland. Property Taxes Maryland Counties.

From www.wmdt.com

Maryland missed a key deadline for property taxes across the state, how Property Taxes Maryland Counties The average property tax rate in maryland is 1.02%. Every august, new tax rates are posted on this website. Web maryland property taxes. Web property taxes vary across maryland based on county. Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home value, and percentage of. Web property tax bills are issued in july/august. Property Taxes Maryland Counties.

From infogram.com

Maryland property tax bills by county Infogram Property Taxes Maryland Counties Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. Web property taxes vary across maryland based on county. The average property tax rate in maryland is. Property Taxes Maryland Counties.

From itep.org

Maryland Who Pays? 7th Edition ITEP Property Taxes Maryland Counties Web maryland property taxes. View the property tax rates in. Counties are responsible for the county tax rates, local. Every august, new tax rates are posted on this website. Taxes on real estate in maryland account for a significant portion of both of. Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and. Property Taxes Maryland Counties.

From paulinawclo.pages.dev

When Are Maryland Taxes Due 2024 Berry Missie Property Taxes Maryland Counties Web property taxes vary across maryland based on county. Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets. Every august, new tax rates are posted on this website. Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home value, and percentage of.. Property Taxes Maryland Counties.

From dailysignal.com

How High Are Property Taxes in Your State? Property Taxes Maryland Counties Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Web maryland property taxes. Web counties and cities depend on the property tax and a portion of. Property Taxes Maryland Counties.

From www.newsncr.com

These States Have the Highest Property Tax Rates Property Taxes Maryland Counties Taxes on real estate in maryland account for a significant portion of both of. The average property tax rate in maryland is 1.02%. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Web maryland property taxes. View the property tax rates in. Every august, new tax. Property Taxes Maryland Counties.

From www.velocitytitle.com

Maryland Property Taxes—Understanding Assessments and Appeals Property Taxes Maryland Counties Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets. The average property tax rate in maryland is 1.02%. Web property tax bills are issued in july/august of each year by maryland’s 23 counties and baltimore city, as well as the 155. Every august, new tax rates are posted. Property Taxes Maryland Counties.

From oysterlink.com

Maryland Paycheck Calculator Calculate Your Net Pay Property Taxes Maryland Counties Every august, new tax rates are posted on this website. Counties are responsible for the county tax rates, local. Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets. Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home value, and percentage of.. Property Taxes Maryland Counties.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Taxes Maryland Counties The average property tax rate in maryland is 1.02%. Counties are responsible for the county tax rates, local. Web counties and cities depend on the property tax and a portion of the income tax to make up their budgets. Web property taxes vary across maryland based on county. Every august, new tax rates are posted on this website. Taxes on. Property Taxes Maryland Counties.

From www.steadily.com

Maryland Property Taxes Property Taxes Maryland Counties Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. Web property taxes vary across maryland based on county. The average property tax rate in maryland is 1.02%. View the property tax rates in. Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home. Property Taxes Maryland Counties.

From conduitstreet.mdcounties.org

Sales Taxes Per Capita How Much Does Maryland Collect? Conduit Street Property Taxes Maryland Counties Web this interactive table ranks maryland's counties by median property tax in dollars, percentage of home value, and percentage of. Web property taxes vary across maryland based on county. Taxes on real estate in maryland account for a significant portion of both of. View the property tax rates in. Counties are responsible for the county tax rates, local. The average. Property Taxes Maryland Counties.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Taxes Maryland Counties Web property taxes vary across maryland based on county. Web maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year. Taxes on real estate in maryland account for a significant portion of both of. View the property tax rates in. Web this interactive table ranks maryland's counties by median property tax. Property Taxes Maryland Counties.